If you have a background of having car insurance coverage policies without filing cases, you'll obtain more affordable rates than somebody that has filed insurance claims in the past.: Autos that are driven much less frequently are less likely to be included in a collision or other damaging occasion. Vehicles with reduced annual mileage may get a little lower prices.

To find the best vehicle insurance coverage for you, you must comparison shop online or talk to an insurance coverage representative or broker. You can, however be certain to keep track of the coverages chosen by you and used by insurance firms to make a reasonable contrast. You can who can assist you discover the ideal mix of price as well as fit.

Independent agents benefit multiple insurance policy firms and also can contrast amongst them, while restricted representatives benefit just one insurer. Offered the different score methodologies and also variables used by insurance firms, no single insurance provider will be best for every person. To better comprehend your common auto insurance policy price, invest time comparing quotes across companies with your selected approach.

Just how much is car insurance policy? The typical expense of vehicle insurance policy is $1,655 per year for complete coverage, according to 2022 rate data. Due to the fact that auto insurance premiums are based on more than a dozen specific ranking factors, the real cost may differ for every driver. Below are some key realities concerning vehicle insurance policy prices: Bankrate insight New york city, Louisiana and Florida are the 3 most expensive states for car insurance typically.

Having a severe offense like a DUI on your electric motor vehicle record can enhance your cars and truck insurance premium by 88% on average. Teenager male motorists might pay $807 more for cars and truck insurance on typical contrasted to teen women drivers.

The Main Principles Of Is Car Insurance In Ga Expensive?

To discover the ideal auto insurance firm for your requirements, get quotes from numerous auto insurance companies to compare rates and also functions. The table listed below displays the typical yearly and also month-to-month premiums for some of the biggest cars and truck insurance coverage firms in the nation by market share. We've also computed a Bankrate Rating on a scale of 0.

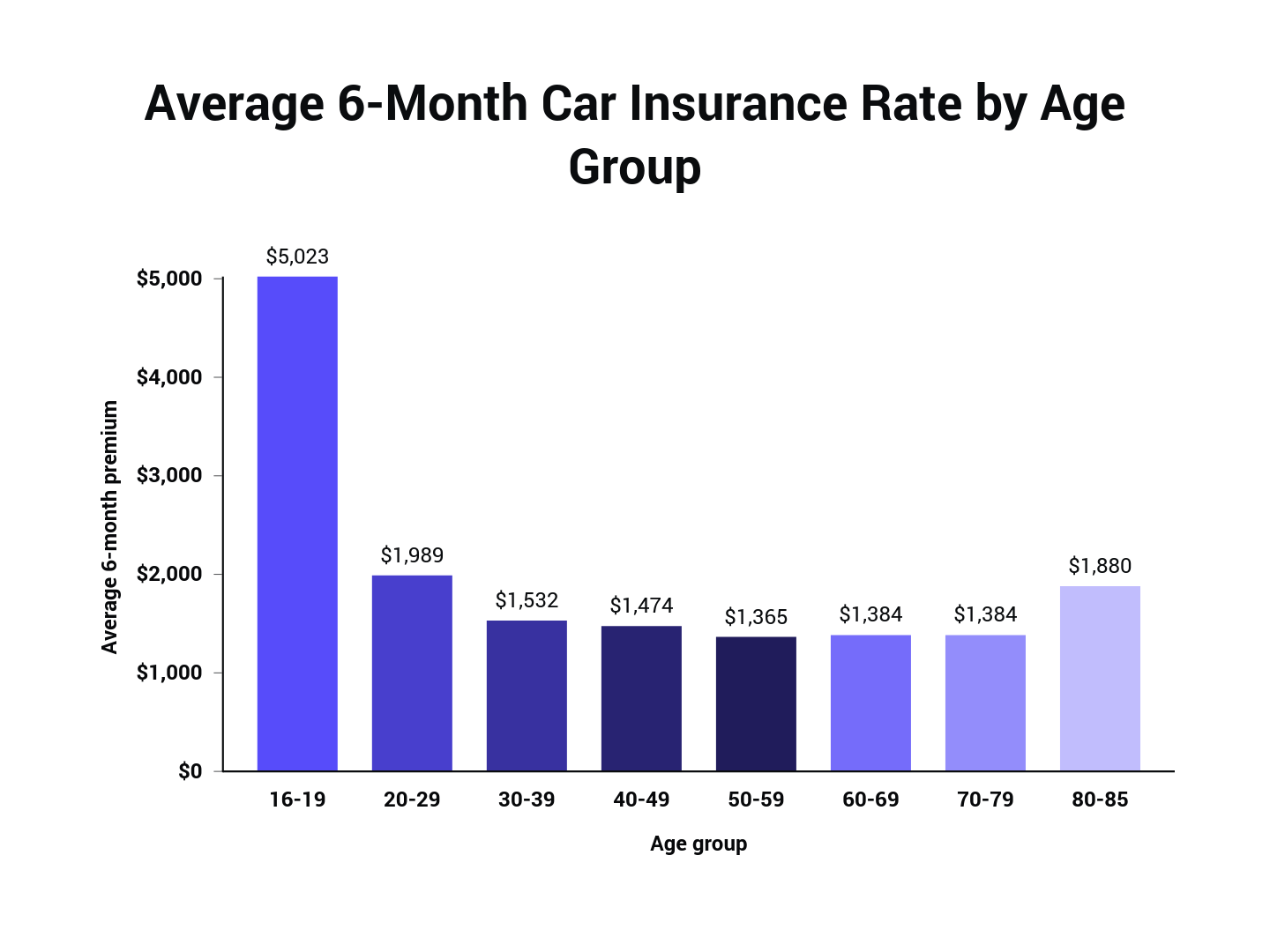

Note that your age will not affect your costs if you live in Hawaii or Massachusetts, as state policies restrict auto insurance companies from utilizing age as a ranking variable. In addition, gender influences your premium in most states. Guy normally cost even more to insure than women. This is due to the fact that guys typically take part in riskier driving habits than ladies and also have a greater price of crash seriousness, according to the Insurance policy Info Institute (Triple-I) - suvs.

risks auto cheap auto insurance insurance company

risks auto cheap auto insurance insurance company

Being involved in an at-fault accident will have a result on your car insurance. The amount of time it will stay on your driving record relies on the extent of the crash and also state laws. As one of one of the most serious driving cases, obtaining a DUI sentence normally enhances your vehicle insurance policy costs even more than an at-fault mishap or speeding ticket.

Just how much does cars and truck insurance coverage expense by credit report? Statistically, drivers with poor credit report submit more claims and also have higher insurance claim severity than vehicle drivers with great credit score, according to the Triple-I. This indicates that, as a whole, the much better your credit history score, the reduced your premium. Your insurance credit report rate is figured out by each auto insurance coverage company and is based on various aspects; it most likely won't exactly match the ratings from Experian, Trans, Union or Equifax as it is a credit-based insurance policy rating, not a credit rating.

These shared functions can consist of: The high rate tag of these vehicles often come with costly components as well as specialized knowledge to fix in the occasion of a claim.

Adding A Teen To Your Auto Insurance Policy - Incharge Debt ... Fundamentals Explained

Insurance policy holders that drive less miles a year often get lower prices (although this gas mileage classification varies by firm). Just how to locate the very best automobile insurance coverage rates, Acquiring car insurance policy does not have to imply damaging the financial institution; there are means to save. Discount rates are one of the very best methods to decrease your premium.

Therefore, insurance experts may advise considering full coverage auto insurance depending on what automobiles you are guaranteeing and also what possessions you have in your name. As an example, if your vehicle is funded or leased, it's most likely that you will certainly need to lug full protection on your automobile. Complete coverage usually refers to greater obligation limitations and even more coverage options, like crash and also detailed, to cover your automobile's damages.

perks credit score insurance perks

perks credit score insurance perks

While complete coverage auto insurance coverage doesn't have a set definition, it normally describes vehicle insurance coverage that has insurance coverage options past the state minimum limits. Most full coverage auto insurance coverage will certainly include clinical repayments insurance coverage, as well as detailed protection and crash insurance coverage to guarantee the vehicle. trucks. Having this added insurance coverage does indicate that your vehicle insurance coverage may be more pricey than if you were just bring the minimal obligation limitations, but the advantage is that it might lower your out-of-pocket prices in the event of a crash.

Insurance providers file brand-new rates with the divisions of insurance coverage in the states they serve each year, so your premium might go through increases or lowers that reflect these new rates. vehicle insurance. Methodology, Bankrate uses Quadrant Information Services to analyze 2022 prices for all ZIP codes and also carriers in all 50 states and Washington, D.C.

Our base account drivers possess a 2020 Toyota Camry, commute five days a week as well as drive 12,000 miles each year. These are example rates as well as need to just be made use of for comparative functions. Rates were determined by reviewing our base profile with the ages 18-60 (base: 40 years) used. Depending upon age, motorists might be a tenant or property owner - cheapest auto insurance.

Bankrate ratings, Bankrate Ratings primarily mirror a weighted rank of industry-standard scores for monetary stamina and client experience in addition to evaluation of priced quote annual premiums from Quadrant Information Services, extending all 50 states and Washington, D.C. We understand it is necessary for motorists to be positive their monetary protection covers the likeliest dangers, is priced competitively and also is offered by a financially-sound business with a background of positive client support.

If a person has an existing insurance coverage policy with AAA (or any kind of other insurance policy business), they have a 14-day to 30-day moratorium to insure their new vehicle, relying on the type of plan. If an individual acquisitions a brand-new automobile and has never ever had an insurance coverage policy previously, they need to buy insurance before they drive off the whole lot.

You can likewise utilize the AAA Mobile app to pay your expense. Just visit and, on the web page, scroll down to Account Actions. Just underneath that, under Insurance, click "Pay Your Insurance.".

The average yearly expense of vehicle insurance coverage in the united state was $1,057 in 2018, according to the most recent information offered in a record from the National Association of Insurance Commissioners. Recognizing that fact won't necessarily help you figure out how much you will be paying for your own protection - prices.

Our The Cost Of Car Insurance Per Month - The Hartford PDFs

To better recognize what you need to be spending for car insurance coverage, it's best to discover the means firms establish their prices (vehicle insurance). Maintain reading for an introduction of one of the most common determinants, and just how you can earn a few extra savings. Calculating Average Yearly Vehicle Insurance Price There are a great deal of aspects that enter into establishing your car insurance policy price.

Right here are some vital factors that impact the typical expense of automobile insurance coverage in America.: Guys are normally considered as riskier vehicle drivers than females. The statistics reveal that ladies have fewer DUI events than males, in addition to less accidents. When females do enter a crash, it's statistically much less most likely to be a severe crash. insurers.

The statistics bear that out, with married individuals entering less crashes. Therefore, married individuals conserve on their prices. Something much less evident is at play here, as well; if your state mandates specific standards for vehicle insurance policy that are stricter than others, you're likely to pay more cash. Michigan, for instance, calls for residents to have endless life time accident security (PIP) for accident-related medical expenditures as a component of their cars and truck insurance coverage.

credit score auto insurance cheap car trucks

credit score auto insurance cheap car trucks

The second the very least expensive state was Maine, complied with by Iowa, South Dakota, as well as Idaho.: If you are using your vehicle as an actual taxi or driving for a rideshare solution, you will certainly need to pay even more for insurance policy, and also you could need to spend for a various kind of insurance coverage entirely. laws.

: The size of your commute, exactly how usually you use your auto, why you use your auto, and where you park all influence your costs. car. If you have a lengthy commute, you are revealed to the risks of the road for longer. If you drive a lot more usually, you're revealed to the dangers of the road a lot more regularly.

All about Average Car Insurance Cost (May 2022) - Wallethub

: This one needs to be pretty apparent. If you have a background of racking up tickets, you are a riskier chauffeur to insure, and also you will pay more in costs. Mounting tracking software application on your car could aid reduce your costs when you have a less-than-perfect history - cheapest car.: That extremely smooth sporting activities automobile you've always wanted? It's not simply going to cost you the price tag: driving a beneficial auto makes you riskier to guarantee.

Insurance costs likewise account for the general safety of an automobile as well as the average cost of repair work. If you're looking to save on insurance, buy a minivan, a reasonable car, or an SUV.

You get what you pay forif you're in a crash, you'll most likely be pleased you really did not choose this as a location to stretch a dollar and also conserve on. cheapest car insurance. On the various other hand, if you never require to make a case, you'll have swiped the added cost savings without consequence.

You currently understand that not all insurance coverage levels are produced equal, however up until you head out as well as see what's available, you will never understand whether you're getting the most effective deal for the quantity of protection you want (cheap insurance).: Are you a straight-A pupil? Energetic responsibility in the armed force? An AAA participant? These are simply a few of the qualities that can make you eligible for a discount on your insurance coverage premium.

: You might obtain a discount for obtaining different sorts of insurance via your car insurance coverage company, such as home or rental insurance coverage. vehicle insurance. Ask a representative what various other insurance coverage is readily available and whether you would certainly obtain a discount for packing the insurance coverage.

Some Of Dreamed Of Owning A Flying Car? This Is How Much It Will Cost ...

Vehicle insurance sets you back approximately $1,202 annually, according to a 2020 report by AAA - vehicle. That claimed, the cost of your insurance policy costs is identified by several variables, so it might be higher or less than average. Below's what you https://10-facts-about-car-insurance-101.fra1.digitaloceanspaces.com must understand about just how much cars and truck insurance coverage prices as well as what can affect your plan costs.

This standard is based upon national data, which takes into account everyone from teen drivers to experienced and also accident-free motorists. Depending upon where you live, how much time you've been driving, just how much you drive, your age and also sex and also several various other variables, the costs you're charged may be really different. accident.